Electric Capital is founded by technology entrepreneurs and investors. Our founders have started multiple companies (four acquired), invested in over one hundred technology startups with a cumulative market cap in the tens of billions, and served as executives at Facebook, Google, and Twitter. We offer our perspective on the emerging market for cryptocurrencies, how we value cryptocurrencies, and how cryptocurrencies will evolve to their end state.

Disclaimer: This document is for informational purposes only, is intended to reflect the opinions of Electric Capital, and is not investment advice. Cryptocurrencies are a risky and volatile asset. Perform significant diligence prior to any investment.

Summary: Programmable Money is the Most Valuable Segment of the Cryptocurrency Market

A broad range of use cases have been predicted for blockchain and cryptography-based protocols. In the near term, we believe the most valuable use cases for cryptocurrencies are non-sovereign, censorship resistant forms of programmable money with a potential network value in the trillions of dollars. Programmable money is rooted in technology that unlocks novel utility today, not the promise of utility in the future if scaling infrastructure emerges. We conclude:

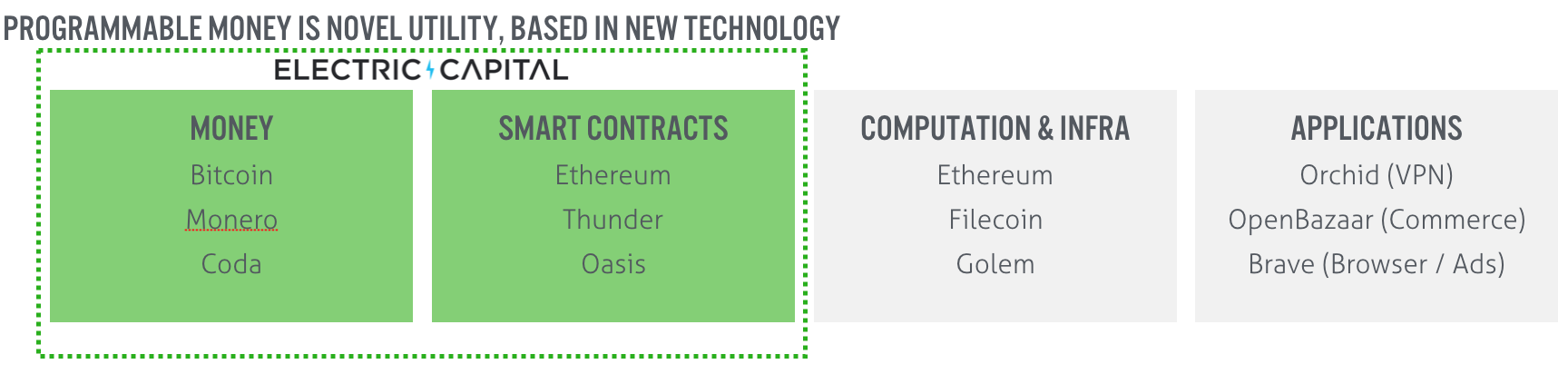

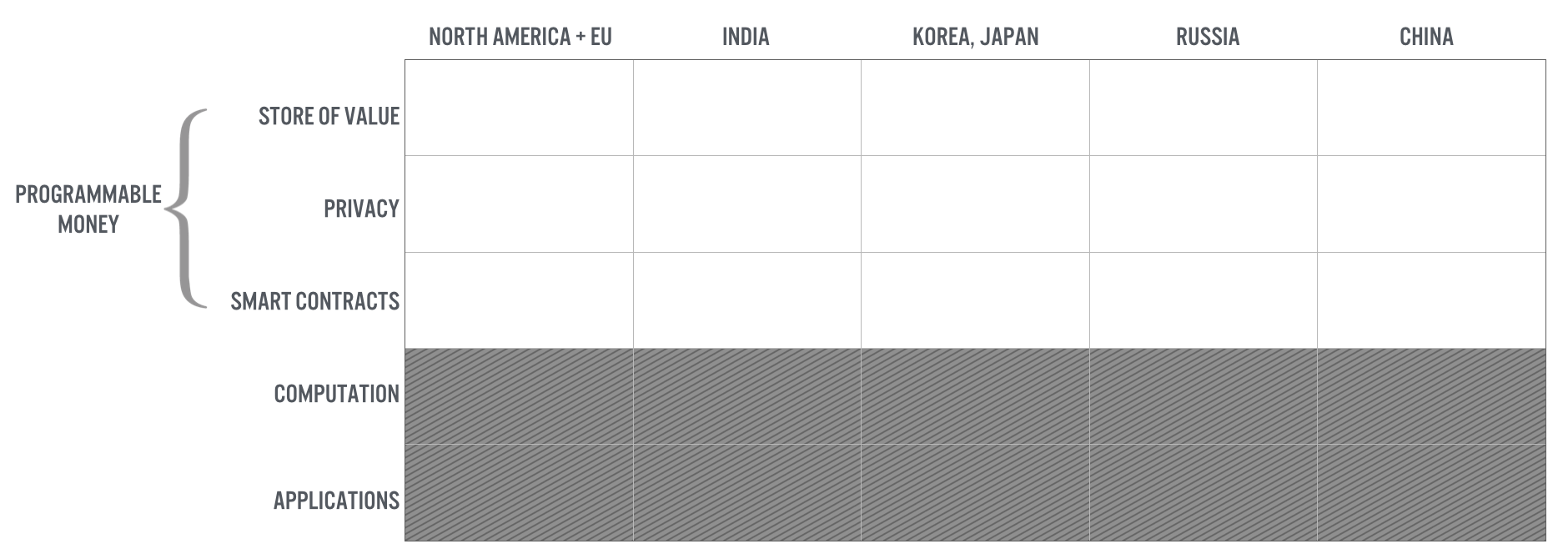

- There are 3 major segments to the cryptocurrency market. We segment the overall cryptocurrency market in to three segments based on functionality: programmable money, decentralized blockchain computer, and decentralized applications. We posit that the programmable money tokens have the greatest immediate utility as well as largest addressable market (in the trillions). In contrast, we find the other two markets to be nascent with lower potential terminal value.

- We believe “Programmable Money” is a multi-trillion dollar opportunity — We believe the largest market size is for cryptocurrencies in the Programmable Money category. Programmable money tokens can earn a premium on their utility as non-sovereign, monetary stores-of-value.

- We anticipate crypto adoption will be subject to the same constraints as other network effect technologies — In considering historical analogs, we expect that cryptocurrencies will likely be constrained by language, culture, and regulation resulting in multiple regional winners. As such, holding a probability-weighted basket of tokens across regions, and across early-stage through public tokens is our favored approach.

- An early stage technology mindset is best when assessing cryptocurrencies — The early user adoption and technology-driven nature of cryptocurrencies suggests assessing these assets via deep technology diligence (running protocol nodes, auditing code bases, meeting technical teams) and deep market analysis (user and network adoption, exchange utilization, etc.). This asset class is best approached with a technological, venture mindset.

- “Programmable Money” is novel utility enabled by new technology — As with prior waves of technology disruption, we must start with where technology enables people to do things they could not previously. The features of programmable money enabled by novel computer science and cryptography are:

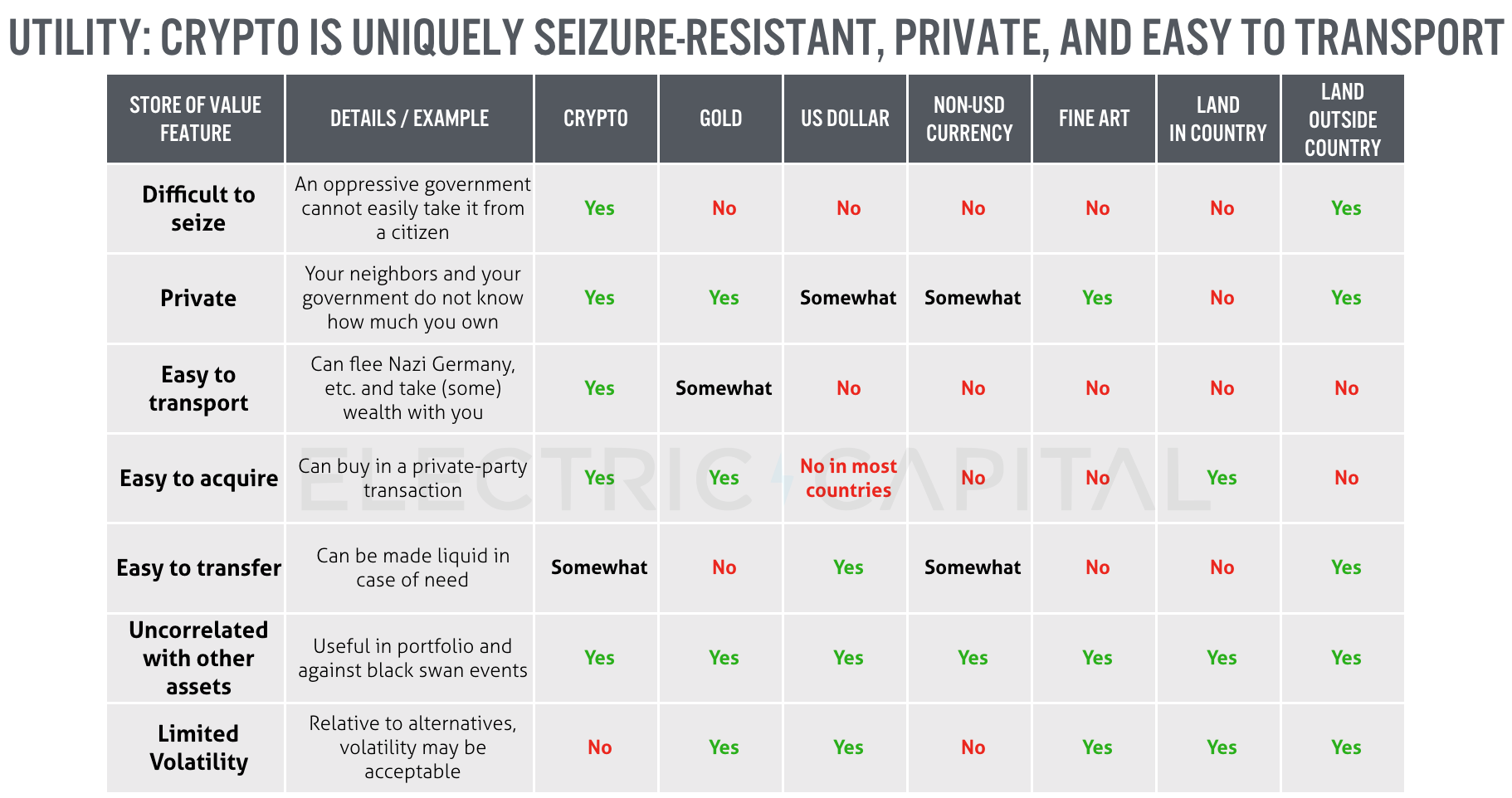

- Seizure-Resistant Store of Value — cryptocurrencies as a cryptographically secured, seizure-proof, and government censorship resistant digital asset are a clear utility. These stores of value allow any individual or institution to hold a globally transmissible asset. We can now transfer $10 million in an hour across country borders for $2. There is clear, novel utility.

- Privacy — anonymity and confidentiality are made possible by new cryptographic techniques such as zk-SNARKs. Private coins enable cryptocurrency equivalents to the offshore and private banking ecosystems worldwide. Private coins serve existing payment use cases and also enable novel use cases that non-private currencies cannot.

- Smart Contracts for Financial Services — smart contracts are financial instruments for derivatives, securitization of assets both digital and offline, lending, escrow, and insurance. Currencies behind smart contracts are both mediums of exchange and units of account, and positioned to become stores of value. This is mutually reinforcing, as a store of value acts as sound denomination for smart contracts.

Cryptocurrency Background / Context

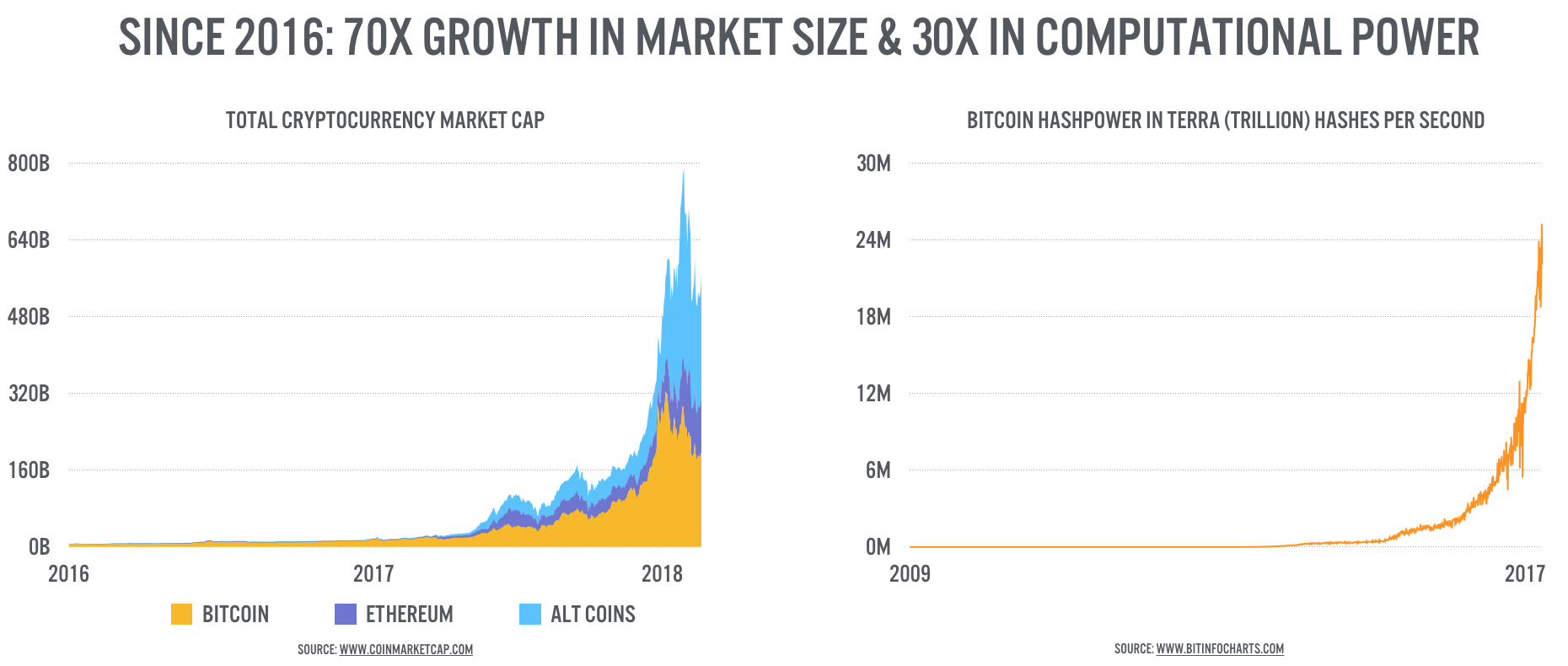

The market has grown 70x since 2016, there is 100x the hashpower that was available in 2016, Bitcoin dominance is below 40%, and crypto as an asset class is still uncorrelated with other assets.

I. Programmable Money is Potentially Trillions in Market and is Useful Today

Cryptocurrency Market Segments: Apps, Computation, and Programmable Money

Cryptocurrencies are a new asset class enabled by novel computer science and mathematics, such as Nakamoto consensus and zk-SNARKs. These innovations unlock use cases that were previously impractical. We classify cryptocurrencies by their use cases in order to forecast a project’s evolution and how the value that may accrue to the underlying token.

We can classify token-based crypto projects in to the following segments:

- Programmable Money (Monetary Stores of Value, e.g. Bitcoin; Private Transactions, e.g. Monero; Smart Contracts, e.g. Ethereum, Thunder)

- Decentralized Computation and Infrastructure, e.g. Filecoin (distributed file system)

- Decentralized Applications, e.g. OpenBazaar (commerce platform)

Programmable Money Is the Most Promising Segment

We posit that Programmable Money (Store of Value, Privacy Coins, Smart Contracts) is the most promising segment because:

- It is useful today with no significant technology blockers.

- The market sizes for Programmable Money are potentially in the trillions of dollars, so investors may still generate significant returns from today’s valuations.

The Distributed Computation and Distributed Application market segments will likely take several years of investment in scalability and security before they are useful. In addition, the network valuations for many of these protocols is not supported by most valuation models today.

Programmable Money is Useful Today

Unlike Distributed Computation or Distributed Applications, Programmable Money is technology that is useful today. For money to fulfill its functions, it needs to be durable, portable, divisible, uniform/fungible, resistant to forgery, and widely accepted. Programmable Money fulfills all of these key features today better than most existing money and stores of value, such as gold.

Programmable Money Is Novel Technology That May Disrupt Markets Worth Trillions

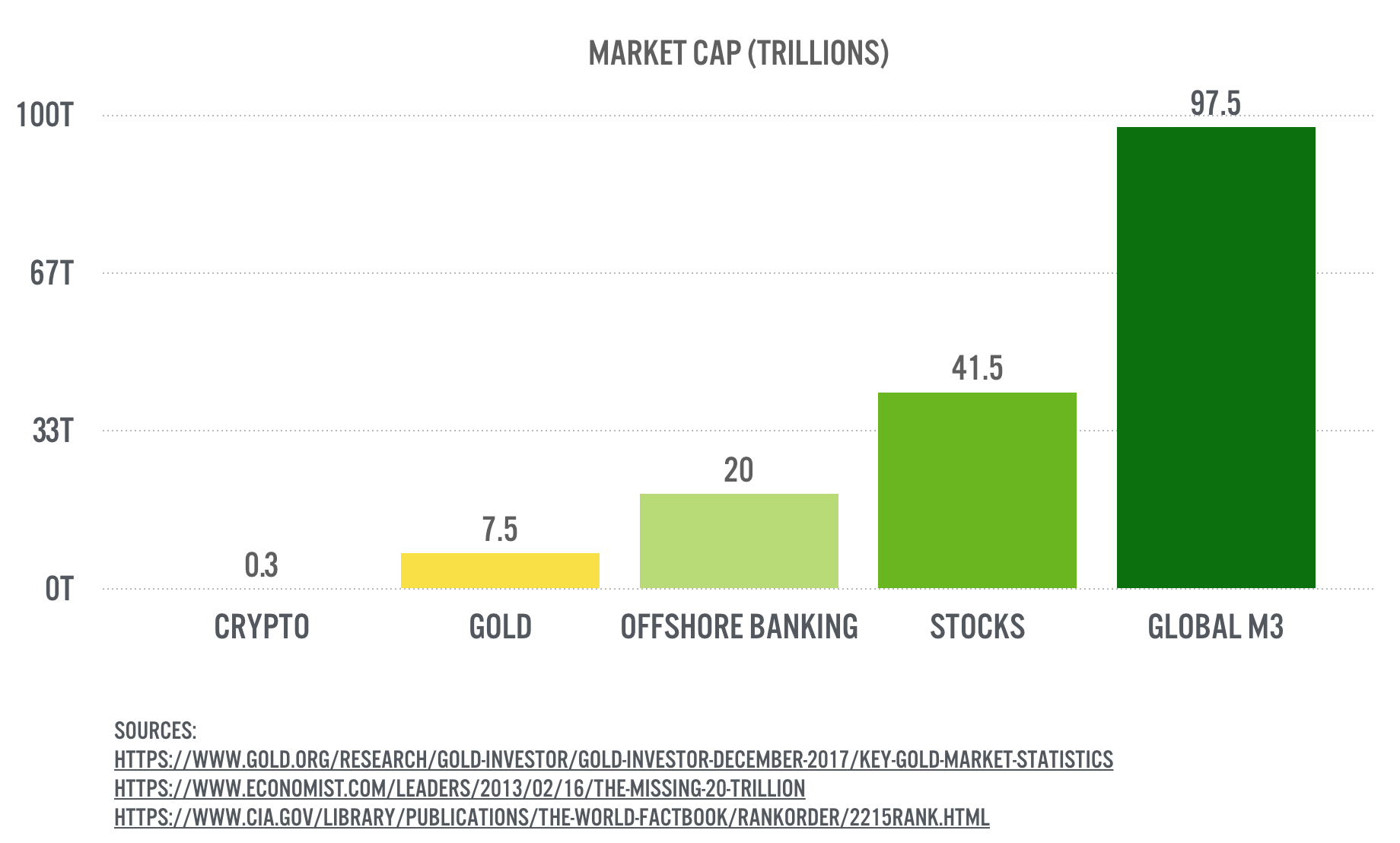

The potential market sizes for a monetary store of value is in the trillions of dollars and an order of magnitude greater than any individual software company. Similar stores of value include gold witha market cap of $7.5 Trillion, $20T in offshore accounts, and global broad money supply (M3) at $97.5T. We believe these markets can be served better by cryptocurrencies.

II. Programmable Money is new technology, driving novel utility

Programmable Money Winners Will Be Rooted in Unique Utility

Though market prices for stores of value are reflexive and reach an equilibrium over time, they are rooted in utility. Gold is inert, has industrial applications, is used as ornamentation and ceremonially, and historically had signaling value. In the era where it was established as a store of value, there were few alternatives for the utilities it provided. Similarly, to understand which Programmable Monies may emerge as winners, we start by analyzing the foundational utility each offers.

We classify Programmable Money via three novel utilities over other forms of money:

A. Store of Value — cryptocurrencies may offer a superior store-of-value to of Gold ($7.5T market)

B. Privacy — a better way to do offshore banking and store assets ($20T market)

C. Smart Contracts — software driven wills, trusts, escrow, securities, REITs, and insurance (many trillions)

A. Store of Value

Potential stores of value such as Bitcoin, Chia, and Coda are decentralized, and thus uniquely seizure resistant and non-sovereign, and can develop in to stores of value. These stores of value target presently inefficient systems such as cross-border payments, moving assets out of the reach of a government, or wealth portability across borders. The throughput of decentralized networks varies but the use cases are distinct from payment networks such as Visa, which are relatively efficient today.

B. Privacy

Modern cryptography allows for highly probabilistically confidential transactions (a third party cannot deduce how much was transacted) and anonymity (a third party cannot determine the participants in a transaction). These techniques work for both currencies and smart contracts that hold currencies. Typically, the more secure an approach, the slower and more cumbersome the currency is to use, and thus the greater the friction for users to adopt it. Cryptographic techniques are rapidly advancing to address performance issues, and combined with gains in computational power, in the future there may no longer be a tradeoff between privacy and ease of use. Private coins are bootstrapping off of the dark markets and private smart contracts will bootstrap off of international private banking (Swiss banking has existed for generations because it offers a real utility). These ecosystems are actually representative of how the existing financial infrastructure operates. Today, money flows in to your possession, others cannot inspect these transactions without your permission, and you and other entities have an obligation to dutifully pay taxes. Privacy coins offer similar protections and features, wherein a user could grant a third party such as the IRS a view-only perspective in to their holdings. The IRS could then audit any irregularities. The combination of modeling existing behaviors and enabling new digital use cases makes privacy coins and private smart contracts a compelling starting point for the adoption of a new currency which could back in to a store of value.

C. Smart Contracts

Smart contracts are the most misunderstood aspect of the cryptocurrency ecosystem. Analysis often conflates Smart Contracts with Distributed Computation, but Smart Contracts should be seen as software “eating” financial contracts that wrap money. For example, Initial Coin Offerings are simple escrow agreements to raise funding and release funds according to rules laid out in code. Smart contract based derivatives, lending, fundraising, banking, and insurance are all being built. By allowing code to directly control money, smart contracts enable novel use cases and can dramatically lower barriers to creating financial infrastructure. Smart contracts may dramatically drop the cost of performing countless high-value transactions such as raising financing, borrowing money, or purchasing insurance. If all of these transactions are backed by a single currency such as Ether, this currency could become a dominant reserve currency for a new crypto economy.

III. Crypto Has The Same Constraints As Other Network Effect Technologies

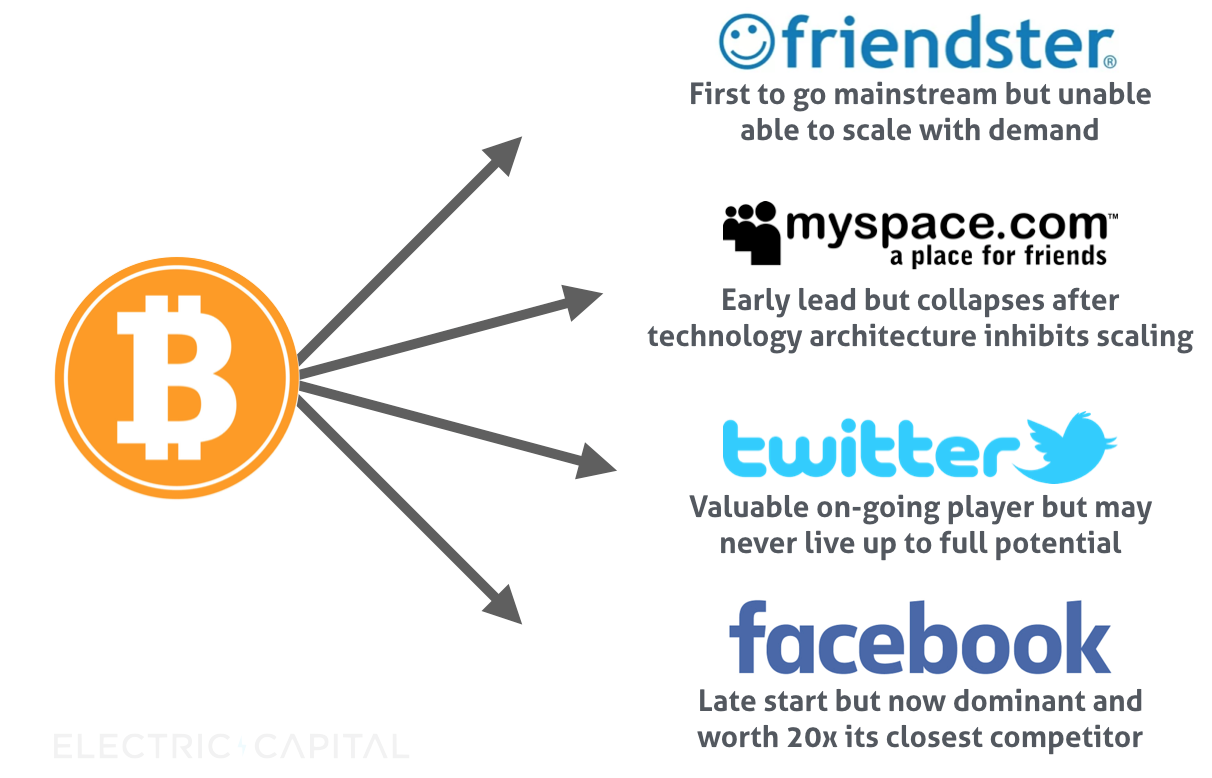

Predicting Winners In Early Stage Markets Is Challenging

Even with known starting points, predicting eventual winners in early stage markets is extremely challenging. There are technology, team, token economics, market, and timing risks. There are potential pitfalls in execution and subtle product decisions can take many years to play out. There are real-world network effects, language barriers, cultural barriers, and regulatory barriers. Programmable Money will be subject to these same influences and constraints.

Early Feature Decisions Can Have Dramatic Downstream Consequences

We find that the history of technology is the history of small decisions made early in the history of a product that have dramatic, unforeseen consequences. From an economist’s perspective, many products are substitutable goods. From a technologist’s perspective, however, seemingly trivial features are critical. Facebook and MySpace took dramatically different forms because of subtle differences such as a policy requiring users to use their real names. The importance of this early decision became apparent only after many years. Ethereum using a Javascript-like smart contract programming language and Tezos using OCaml as its programming language creates tradeoffs between the security of a smart contract and how many developers can actually develop in the ecosystem. It is presently unclear which tradeoff will be more successful.

Geography and Culture Have Dramatic Downstream Consequences

Ultimately, technology is used by humans, and thus culture, language, regulation, government intervention, customer acquisition, nationalism, and other factors are significant influences on adoption.

The Chinese government, for example, has shown a tremendous ability to understand technology, king-make a domestic winner, inhibit non-Chinese competitors, and prop up the Chinese winner as a regional (and potentially a global) winner. Baidu, Didi, Tencent, and Alibaba are all examples. It is reasonable to anticipate that the Chinese government will do the same in crypto — they may allow cryptocurrencies to proliferate, then may ban them, then may king-make a domestic cryptocurrency which also affords them influence outside of China. The likely tradeoff would be economic gain for the holders of the currency in exchange for lack of censorship resistance.

Similarly throughout the history of technology, Korea, Japan, and South-East Asia have had winners independent of the rest of the world, e.g. LINE in Messaging or Naver in Search. Russia and the former Soviet countries have a similar history with Yandex, Mail.ru, and VKontakte. The EU has passed regulation that enforces data protection and privacy far more stringently than the rest of the world, which may create catalysts for adoption of coins that are more privacy conscious. And India is enforcing increasingly strict capital controls, thus potentially creating another separate market.

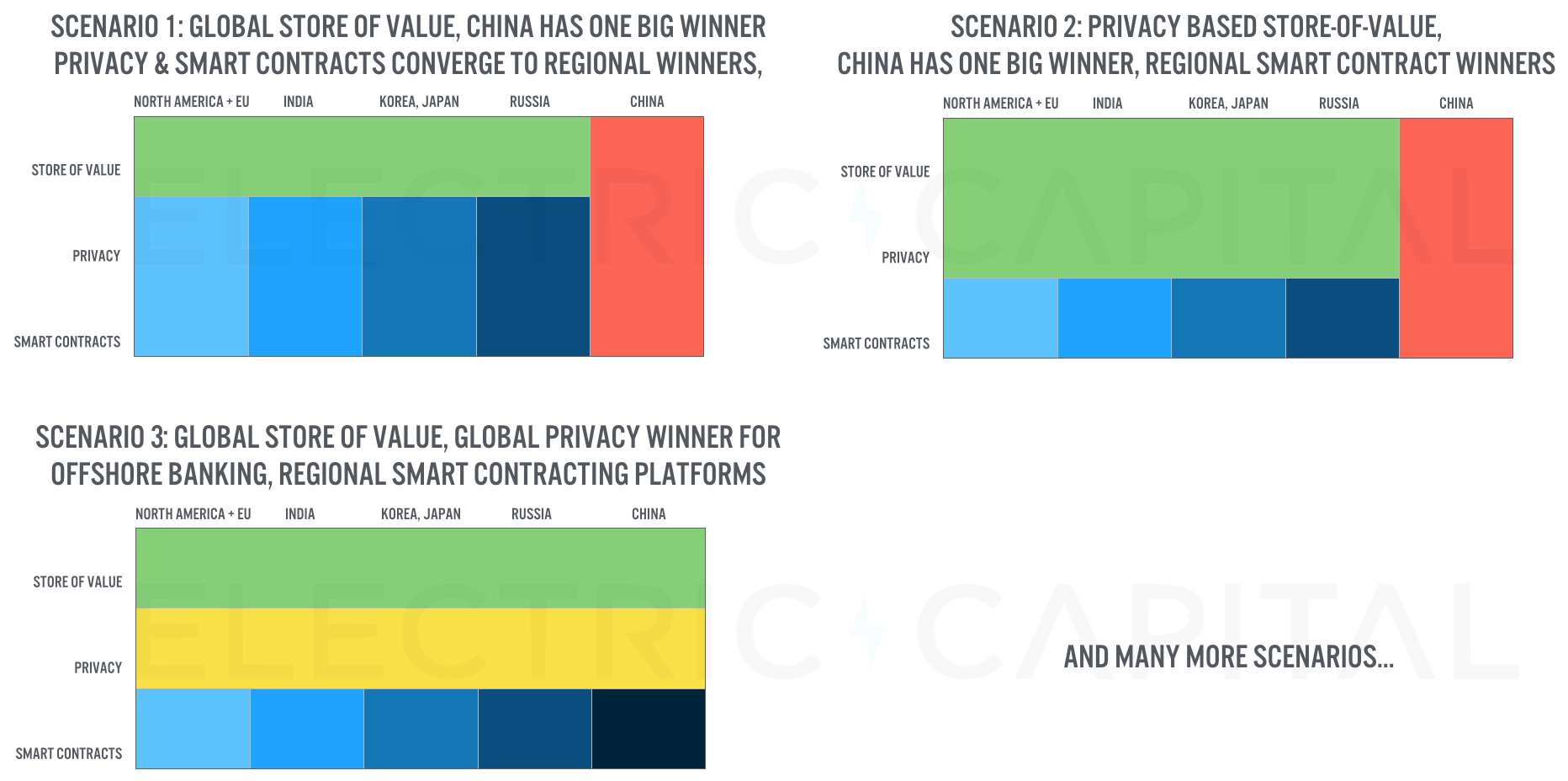

Programmable Money will be influenced by all of these geographic and cultural factors, which makes picking a single winner significantly more challenging. In considering these geographic starting points for potentially global winners and the technological utilities that programmable monies offer, there is a large matrix of potential cryptocurrencies that may emerge as widely adopted.

Programmable Money may have 100x Growth Potential

As with any early-stage technology market, we cannot know the winners or their terminal network values. Some of the eventual winners may today be early-stage companies with illiquid tokens. We must assess which technologies are real, when network effects are real, and teams capable of creating long-term value.

For example, it is possible we end up with with one Chinese winner and one Rest of World winner, as we have in search engines. Or perhaps we have one global store of value and one globally dominant privacy coin that serves a role similar to the Swiss banking system. Relatedly, these technology platforms may converge over time. As winners emerge for each of the three unique features of Programmable Money (low fee settlement, privacy, and smart contracts), these winners will start to compete with each other. Ethereum may add zk-SNARKs (or STARKs), Rootstock smart contracts may launch on Bitcoin, and a privacy token may build private smart contracts.

If a privacy token implements smart contracts, however, they will make dramatically different design decisions than Ethereum. These smart contracts will be better for some use cases and much worse for others. Subtle decisions such as opt-in vs. opt-out privacy will have dramatic downstream consequences on use cases, adoption, and network effects. Along the way, new projects may start from scratch and incorporate all of the learnings from past projects, without any of their technical or community baggage. Predicting which of these products ultimately wins is extremely difficult.

Though we cannot predict how the potentially multi-trillion dollar market for programmable money will emerge, outsized returns are possible in many scenarios. Even in a winner-takes-most scenario, picking secondary winners could generate tremendous returns. For example, if Bitcoin emerges as the eventual winner of store of value and is worth $5 Trillion, a privacy coin may exist alongside Bitcoin and be worth 10% as much, at $500B. That would be a 250x return for today’s leading privacy coin, Monero.

As great early stage investors know, rather than trying to predict these winners, it is much better to identify and build a basket of potential winners based on deep technical and market diligence. Over time as winners become more obvious, the optimal strategy is to concentrate positions in winners.

Source: Medium